The Federal Response to the Pandemic

I am often asked if this current crisis is different than other times of challenge. Of course, the big difference is this crisis is virus related and the fortunes of the economy in large part are impacted by the course of the disease and its potential treatment. One cannot escape this reality; the virus will dictate how the economy grows or contracts.

However, there is another important difference. We have not seen a coordinated response from the federal authorities to this degree since the Great Depression. This includes legislative action, executive orders, and stimulative action taken by the Federal Reserve.

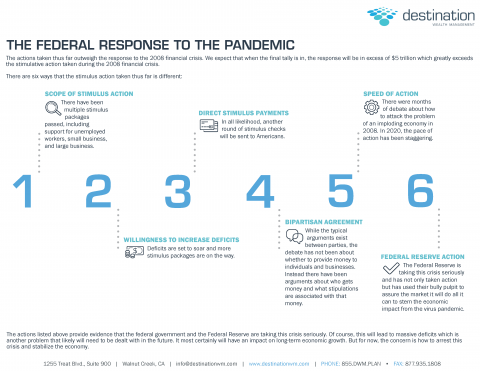

The actions taken thus far outweigh the response to the 2008 financial crisis. We expect that when the final tally is in, the response will be in excess of $5 trillion which greatly exceeds the stimulative action taken during the 2008 financial crisis.

There are six ways that the stimulus action taken thus far is different:

- Scope of stimulus action: There have been multiple stimulus packages passed, including support for unemployed workers, small business, and large business. We will likely see action taken to support municipal state governments as well. The sheer volume of dollars attacking this problem is unprecedented.

- Willingness to increase deficits: In 2008 there was an argument around “too big to fail” actions by policymakers which centered around if it was a reasonable action for the government to insert dollars into businesses. The great concern was the potential to increase deficits. That concern does not exist today in any meaningful way. Deficits are set to soar and more stimulus packages are on the way.

- Direct stimulus payments: In 2008-2009 there were stimulus payments sent to Americans, but the sheer magnitude of the program implemented in 2020 will be significantly greater. In all likelihood, another round of stimulus checks will be sent to Americans.

- Bipartisan agreement: While the typical arguments exist between parties, the debate has not been about whether to provide money to individuals and businesses. Instead there have been arguments about who gets money and what stipulations are associated with that money. You do not see arguments that payments should not be provided to businesses and individuals. The belief that this is necessary is bipartisan.

- Speed of action: There were months of debate about how to attack the problem of an imploding economy in 2008. In 2020, the pace of action has been staggering. This has resulted in some mistakes and a consistent flow of revised regulations but has not stopped legislators from plowing forward with additional action. The pace is amazing.

- Federal reserve action: The federal reserve was active in 2008 under Chairman Ben Bernanke. However, under Chairman Powell, the level of activity and the scope of the effort is unprecedented. It is fair to say that the actions taken will far exceed the efforts made during the 2008 financial crisis. The Federal Reserve is taking this crisis seriously and has not only taken action but has used their bully pulpit to assure the market it will do all it can to stem the economic impact from the virus pandemic.

The actions listed above provide evidence that the federal government and the Federal Reserve are taking this crisis seriously. Of course, this will lead to massive deficits which is another problem that likely will need to be dealt with in the future. It most certainly will have an impact on long-term economic growth.

But for now, the concern is how to arrest this crisis and stabilize the economy. I expect this perspective to continue and it will have investment implications. Growth will likely be slower, interest rates will likely remain very low, deficits will soar, and other unforeseen consequences will likely emerge that will impact DWM's perspective on how to invest portfolios. You can be assured current events are impacting our long-term investment positioning.

The opinions expressed herein are provided for informational purposes only and are not intended as investment advice. All investments involve risk, including loss of principal invested. Past performance does not guarantee future performance. Individual client accounts may vary. Although the information provided to you on this site is obtained or compiled from sources we believe to be reliable, Destination Wealth Management cannot and does not guarantee the accuracy, validity, timeliness or completeness of any information or data made available to you for any particular purpose. Any links to other websites are used at your own risk.